LCOH,绿色氢的价格是如何计算的?

Green Hydrogen is the energy vector already emerging as one of the key tools to achieve global decarbonisation.

绿色氢是能源载体,已经成为实现全球脱碳的关键工具之一。

Driven by climate urgency and countries' commitments to net zero emissions production, IRENA estimates that Hydrogen will account for up to 12% of global energy use by 2050. These same studies also predict that the cost of hydrogen installations could decrease by 40% to 80% in the coming years. This article tells you how hydrogen prices are set and what variables are involved in the matrix.

在气候紧迫性和各国对净零排放生产的承诺的推动下,IRENA估计,到2050年,氢将占全球能源使用的12%。这些研究还预测,未来几年氢气装置的成本可能会下降40%至80%。本文告诉您氢气价格是如何设置的以及矩阵中涉及哪些变量。

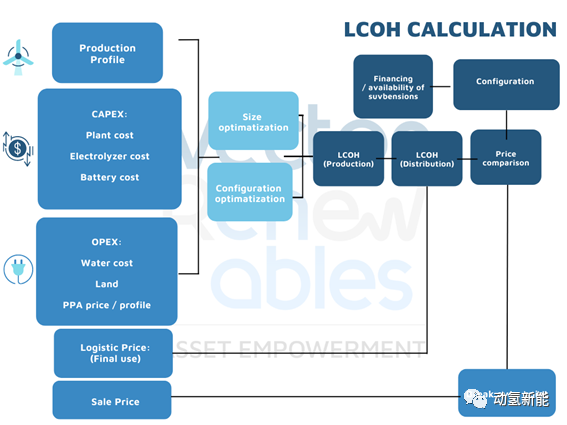

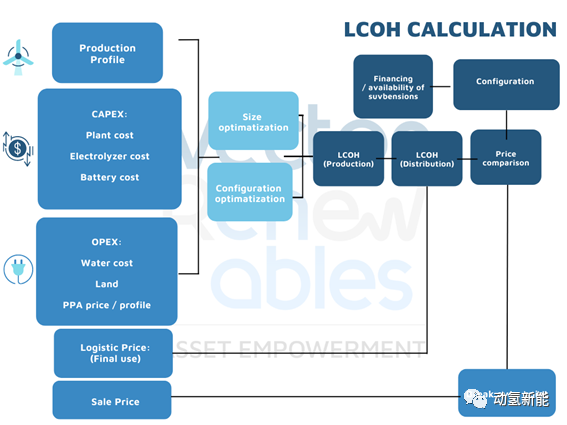

The Levelised Cost of Hydrogen (LCOH) is a variable that indicates how much it costs to produce 1 kg of Green Hydrogen, taking into account the estimated costs of the investment required and the cost of operating the assets involved in its production.

氢的平准化成本(LCOH)是一个变量,表示生产1公斤绿氢的成本,考虑到所需投资的估计成本和生产中涉及的资产的运营成本。

Thus, we can say that, in order to obtain this calculation, all the relevant variables that affect the production of Hydrogen are taken into account, among which are included:

因此,我们可以说,为了获得此计算,考虑了影响氢气生产的所有相关变量,其中包括:

The annual hourly production curve of the renewable resource. This shows the energy production over a year at each hour. Naturally, it depends on the selected geographical location and its meteorological conditions, such as the level of solar irradiation and/or the wind resource. At the same time, the technology chosen for the renewable resource will also affect this critical parameter. Therefore, the more reliable the production curve information is, the more accurate it will be, leading to a more precise calculation of the LCOH, as it will tell us how much renewable energy is fed into the system

可再生资源的年每小时产量曲线。这显示了一年内每小时的能量产生。当然,这取决于所选的地理位置及其气象条件,例如太阳辐射水平和/或风力资源。同时,为可再生资源选择的技术也将影响这一关键参数。因此,生产曲线信息越可靠,就越准确,从而更精确地计算LCOH,因为它将告诉我们有多少可再生能源被送入系统The CAPEX capital cost is purchasing new equipment or upgrading existing capital to produce Hydrogen. Included in these costs is the cost of the equipment required. This will be strongly affected by the renewable energy system adopted, the electrolyser technology selected (alkaline, PEM, SOEC) and the characteristics of the auxiliary services involved, such as water treatment, the compression and cooling system or Hydrogen storage, among others. Therefore, the more precise the technology selection, the more reliable the result will be.

资本支出的资本成本是购买新设备或升级现有资本以生产氢气。这些费用中包括所需设备的费用。这将受到所采用的可再生能源系统、选择的电解槽技术(碱性、PEM、SOEC)以及所涉及的辅助服务特性(如水处理、压缩和冷却系统或储氢等)的强烈影响。因此,技术选择越精确,结果就越可靠。The OPEX cost is operating and maintaining the production facility. It is the expenditure incurred in the normal operation of the plant's production. This estimate considers water consumption, the cost of renting the land, or the annual maintenance required for all the assets. An important factor to consider in this cost is the potential use of energy from the electricity grid. When the business model believes that this consumption is desirable, the Power Purchase Agreement (PPA) must be very well detailed as it will affect not only the taxonomy of the Hydrogen produced but also the financial modelling.

运营支出成本是生产设施的运营和维护。它是工厂生产正常运行中发生的支出。该估算考虑了用水量、租用土地的成本或所有资产所需的年度维护。在此成本中要考虑的一个重要因素是电网能源的潜在使用。当商业模式认为这种消耗是可取的时,购电协议(PPA)必须非常详细,因为它不仅会影响生产的氢气的分类,还会影响财务建模。

The size of the electrolyser will be optimised through these three main parameters

电解槽的尺寸将通过这三个主要参数进行优化, considering the best power supply configuration, according to the previously described points.

,根据前面描述的要点考虑最佳电源配置。

Furthermore, depending on the state of aggregation of the Hydrogen for its final consumption, its temperature and pressure requirements for logistical reasons, and the potential purchase price of the sector that acquires it, there will be different margins adapted to each situation which will condition the LCOH.

此外,根据氢气最终消费的聚集状态、物流原因的温度和压力要求以及收购氢的部门的潜在购买价格,将有不同的利润适应每种情况,这将影响LCOH。

With the analysis and consideration of all the above variables, it will be possible to study and determine the break-even point for the proposed business model. With this, different modelling scenarios are assumed and calculated, and a ranking of the best options for each case study is established. The final result will also be impacted if external grant funding is available, which will favour the LCOH calculation.

通过分析和考虑上述所有变量,将有可能研究和确定拟议商业模式的盈亏平衡点。有了这个,假设和计算不同的建模场景,并为每个案例研究建立最佳选项的排名。如果有外部赠款资金,最终结果也将受到影响,这将有利于LCOH计算。